Seoul, Republic of Korea, March 10 2020 – GGGI’s Impact & Evaluation Unit (IEU), in collaboration with external green investment specialists from Finergreen Asia Pte. Ltd., recently completed and published an evaluation of GGGI’s Green Investment Services.

Seoul, Republic of Korea, March 10 2020 – GGGI’s Impact & Evaluation Unit (IEU), in collaboration with external green investment specialists from Finergreen Asia Pte. Ltd., recently completed and published an evaluation of GGGI’s Green Investment Services.

Under GGGI’s Strategic Plan 2015-2020, one of three key priorities was to increase green investment flows in members and partner countries. A Green Investment Services (GIS) department was created in 2015 and given lead responsibility for driving this strategic agenda. Since then, GGGI has developed its implementation approach and built up a team and reported a total of USD 1.2 billion of investments mobilized between 2015-2018 towards green growth activities in members and partner countries.

For the period beyond 2020, a new Strategy 2030 was formally adopted by GGGI’s Council in October 2019. The new strategy sets an ambitious target for GGGI to mobilize USD 16 billion over the period 2017-2030. This evaluation provided an opportunity for GGGI to take stock of past successes and lessons and to inform efforts to scale up green investment mobilization moving forward.

The headline findings were:

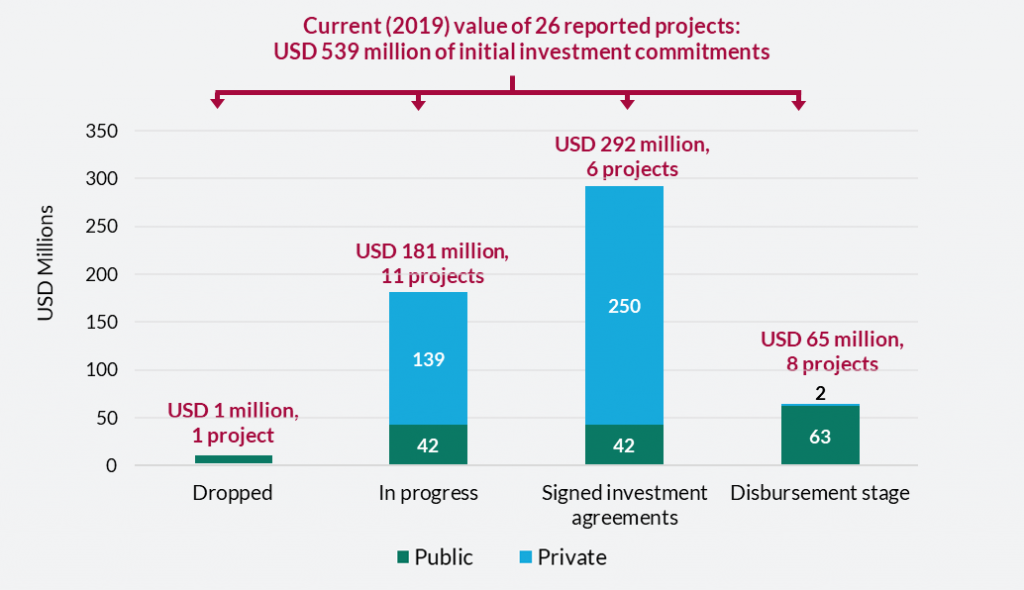

- The majority of projects are moving forward to financing & implementation: Two thirds (or USD 357 million) of the total investment commitments of USD 539 million evaluated has advanced to signed investment agreements or disbursement stage. Only 0.1% of the total value has been dropped. The private sector has committed to raise USD 391 million (73%) of the total investments

- Projects have demonstrated adoption of scaling up strategies but it remains too early to see the results yet: A stronger focus on finding effective ways to scale will be increasingly important for GGGI, in order to meet its Strategy 2030 targets

- GGGI serves a niche need in the market for green investment services and clients value its service offerings: GGGI has focused on near-commercial green and climate projects that would not get financed if GGGI did not intervene – a niche that few other organizations are serving.

The evaluation identified specific lessons and opportunities to improve the delivery and impact of GGGI’s green investment services. These can help inform decisions on the future of GGGI’s green investment services, as part of the implementation of the new Strategy 2030.

The evaluation identified specific lessons and opportunities to improve the delivery and impact of GGGI’s green investment services. These can help inform decisions on the future of GGGI’s green investment services, as part of the implementation of the new Strategy 2030.

“The evaluation confirms that GGGI’s GIS work fills a quite specific niche and is well appreciated by our partners.” said Director-General, Frank Rijsberman. “It concludes that our early exit point is well chosen and that almost all the projects for which GGGI has mobilized green and climate finance are indeed moving forward to implementation. This is a very strong endorsement of our overall approach with some helpful recommendations for further improvement.”

“The evaluation report is indeed a strong endorsement of GIS’s early achievements as developer of green projects in emerging markets and mobilizer of climate and green financing,” said Head of GIS, Lasse Ringius. “By making sure that investor expectations in terms of feasibility and bankability are met, GIS is creating a pipeline of impactful green projects for implementation in GGGI member countries. The evaluation confirms that GGGI’s GIS offers a rather unique value-add as an international organization insofar as it helps green and climate projects overcome the obstacles they face, in particular in the early preparation phases.”

An evaluation brief and detailed evaluation report has been published on GGGI’s evaluation website.

For more information, please email Impact and Evaluation Unit at ieu@gggi.org.